Options for Social Security

Posted by Charles Pineles-Mark onMarch 8, 2017 - Congressional Budget Office

While delivering testimony at Congressional hearings in February, CBOfs Director was asked a number of questions about potential changes to Social Security. Because answers during hearings are inherently brief, this blog post provides some additional information.

What Are CBOfs Projections for Social Security?

Social Security is the largest single program in the federal governmentfs budget. CBO projects that the programfs outlays will rise significantly over the coming decades—from 4.9 percent of gross domestic product (GDP) in 2017 to about 6.3 percent of GDP 30 years from now. Average benefits per recipient are expected to continue to increase at roughly the same rate as per capita GDP. However, a significantly larger portion of the population will begin to draw benefits because more of the baby-boom generation will reach retirement age. Their longer life spans will result in those beneficiariesf receiving payments for more years than was the case in the past, thus increasing the total amount of benefits the average retiree receives over a lifetime. Those factors will combine to cause the growth in benefits as scheduled under current law to outpace the growth in the economy overall.

Total revenues for the program, however, are anticipated to decline slightly in relation to the size of the economy, from 4.6 percent of GDP in 2017 to 4.5 percent of GDP 30 years from now. The decline is expected to occur because most of the programfs receipts come from the payroll tax—a flat-rate assessment (up to a maximum amount per worker, which is indexed to average earnings)—and because the proportion of earnings subject to the payroll tax is expected to shrink.

What Are Some Options for Changing Social Security?

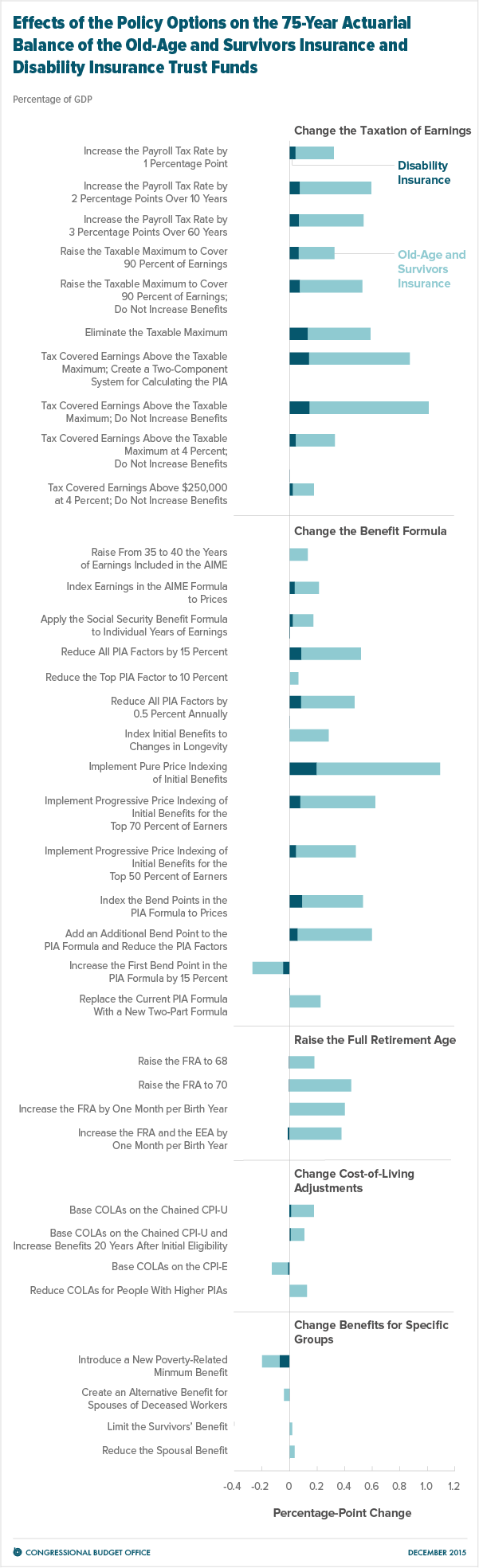

In a 2015 report, CBO considered 36 policy options that are among those commonly proposed by policymakers and analysts, divided into five groups according to the elements of the Social Security program that they would modify:

- The taxation of earnings,

- The benefit formula,

- The full retirement age,

- Cost-of-living adjustments, and

- Benefits for specific groups.

Although CBO has not updated its analysis of those options, the agency expects that updated estimates of the optionsf long-term effects would be broadly similar to those reported in 2015. For example, CBO reported that gradually increasing the payroll tax rate by 3 percentage points over 60 years would improve the 75-year actuarial balance by 0.5 percentage points of GDP, as would gradually reducing benefits by 15 percent for newly eligible beneficiaries over 10 years, starting in 2023; each of those options would eliminate about one-third of the shortfall in the programfs finances. (The actuarial balance is the sum of the present value of projected tax revenues and the current trust fund balance minus the sum of the present value of projected outlays and a yearfs worth of benefits at the end of a given period. A present value is a single number that expresses a flow of future income or payments in terms of an equivalent lump sum received or paid at a specific point in time.)

By itself, no individual option that CBO examined would create long-term stability for the Social Security program (see the figure below). Some options would affect all workers or beneficiaries similarly; others would have widely disparate effects, depending on a beneficiaryfs year of birth or lifetime earnings. The effects of many of the options could be changed if they were implemented at a larger or smaller scale or phased in more slowly or quickly, although the resulting effects would not necessarily be proportional to the results presented in the report. If the goal was to address Social Securityfs long-term imbalance, it would be necessary to combine several of the options that CBO analyzed. However, the effects of several policy changes implemented together are not always equal to the sum of the individual effects of those policy changes.

Charles Pineles-Mark is an analyst in CBOfs Health, Retirement, and Long-Term Analysis Division.